|

Introduction Festival is a day or days of celebration of an organized series of cultural and social concerts or to remember an event to promote the cultural heritage of the society Poverty could result from transient phenomena and sudden shocks such as crop failure, untimely death etc. The impact of such shocks can be transient in the event of the household being able to sell assets or borrow or generate income from alternative employment opportunities that enable it to wait for income from the next harvest. However, if the household has no assets to sell or no access to credit, or is able to borrow at exploitative rates of interest and gets into a debt trap, shocks can have long duration ramifications in terms of pushing households below the poverty line. Baulch and Hoddinott (2000) distinguish between idiosyncratic and covariant shocks. Covariant shocks could affect all households in this locality while an idiosyncratic shock may be restricted to only a given household. They point out that the “absence of detailed studies on the cumulative impact of shocks represents a particularly serious lacuna in our knowledge of processes of economic mobility” that there are a “myriad ways in which both positive and negative shocks – including pure bad luck, thefts loss of employment, and the cumulative effects of droughts – lead to impoverishment” and that households with greater endowments and greater returns will tend to be less vulnerable to shocks. Also children, women and the elderly are more vulnerable. Vulnerability also has caste and geographical dimensions (Baulch & Hoddinott, 2007). The empirical literature has mostly focused on the determinants of household debt burden and financial distress (May, Tudela, & Young, 2004) (Rio & Young, 2008) Highly indebted households are “financially fragile”, i.e. are more likely to default on their loan commitments, especially when hit by adverse income shocks (Jappelli, 2008.). According to theory (Modigliani and Brumberg 1954, Ando and Modigliani 1963), households decide to take a loan as a way of anticipating spending, based on expectations of increased future income receipts; within this framework, indebtedness, as well as saving, guarantee heightened economic welfare by smoothing consumption over time. However, in recent years household debt, in particular unsecured debt (i.e. consumer credit), has recorded high levels of growth and this has raised concerns about whether household debt may be inconsistent with the optimising behaviour of intertemporal consumption and may instead be associated with prevailing financial and economic difficulties of indebted households, at least for some categories of borrowers and/or in some local contexts. In this case, households may risk a level of indebtedness that is unsustainable in relations to their earnings, and this may lead to financial vulnerability (Vandone, 2009). Kamath, Rajalaxmi; Mukherji, Amab; Ramanathan, Smita (2008) have conducted research on “Ramanagaram Financial Diaries: Loan Repayments and Cash” For the study 90 odd pages diary that they gave to the 20 households was unstructured, each page (corresponding to one day) in a two-columnar format, asking the households to report the rupee amount that was spent on expenditures or income inflows in the household on each day. The study began with a group of twenty poor households who were either borrowing from a microfinance institution (MFI) or were a part of a self-help group (SHG). The households were chosen from two locations in Ramanagaram; Hajinagar and Ambedkarnagar. These expenditures for the entire sample shows the purpose for which the borrowings were made. Greatest proportion of the total borrowings during this period went into repaying other loans (informal loans - moneylender, chit-funds, finance companies) but a lot was being used on festival related expenditure - accessories, jewellary, clothes, festivals and events (which in this case meant social events like birthdays). Borrowings have also been used for repayment of microfinance installments. Average expenditures of microfinance borrowings from the respondents for festival expenditure 1775 INR and expenditure on events 813 INR respectively (Kamath, Mukherji, & Ramanathan, Ramanagaram Financial Diaries: Loan Repayments and Cash, 2008). Kamath, Rajalaxmi; Dattasharma, Abhi (2015) have conducted study on “Women and Household Cash Management: Evidence from Financial Diaries in India” the study found that, peculiar to the women headed households, especially those that are better off and who take MFI loans is the expenditure of a religious nature. This could vary from expenditure during the time of religious festivals to expenditure on daily religious rituals. This item does not figure anywhere among the male headed households. Spending on religious items refers to money spent on religious festivals religious rituals at home, or visits to temples. Given this vulnerability in their lives, expenditure on religion needs to be seen as a ministration from this daily grind (Kamath & Dattasharma, Women and Household Cash Management: Evidence from Financial Diaries in India, 2015). Indians are different from western individual, they are driven by family, caste and other social Institutions (Marriot & Inden, 1977). In recent study by Mines (1994) he argues that Indians are has individuality. But this individuality is quite different from western model of individuality. Indian individuality is more exterior or civic than personal and significant conditioned by how others evaluate the person. What kind of person he is? How influential is he? Henceforth “civic individuality” determined within the context of where individual belongs: their caste, Religion, community (Mines, 1994). Rationale of the study Festival expenditures amount to over 15 percent of a household’s annual expenditures in rural India. Yet the area has studied by few (Rao, Festival Expenditures, Unit Price Variation and Social Status in Rural India, 2001). Spending on festivals seen as tiny but series of spending accumulate in to high impact on total income of the households. However in India people are more driven by cultural influence hence, they will not feel spending on festivals as a burden. Festivals are both cultural and social events. They occur in a unique setting that enables the enactment of authentic works, often providing new interpretations. Franklin Allen and Douglas Gale define financial fragility as the degree to which “small shocks have disproportionately large effects (Allen, 2004). Herewith small shocks denote, spending on festivals looks like small but its effect on financial vulnerability of household’s intern it will lead to determine countries GDP. The financial services industry considers that households that devote more than 40 per cent of their income to service their debt are financially vulnerable (Shubhasis Dey, 2008). Objectives of the study

Material and Method The study was descriptive in nature; hence descriptive research design was used for the research. 50 samples were collected from household especially from rural area of Tumkur district with the help of purposeful sampling technique. For the study assessment of socio-economic condition of the respondents Uday Pareek’s socio-economic scale was used. Along with that, based upon class stratification researcher assessed mean income and spending on festivals how the spending creates indebtedness and financial vulnerability of rural households in long run. Data were collected from Tumkur district 10 villages 5 households from each villages. Limitations of the study

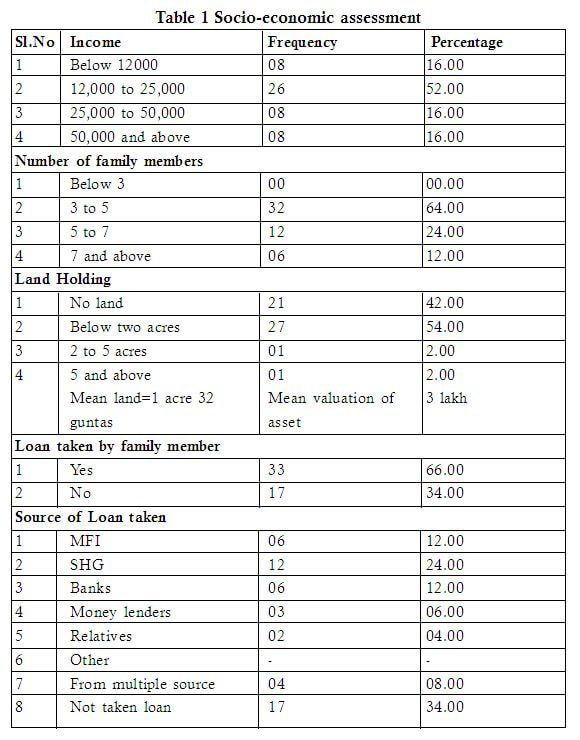

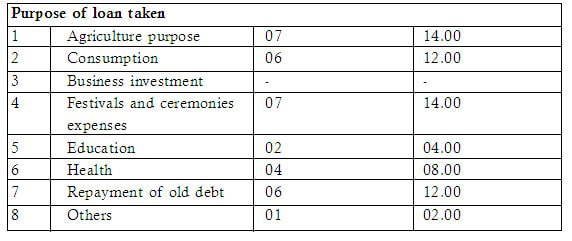

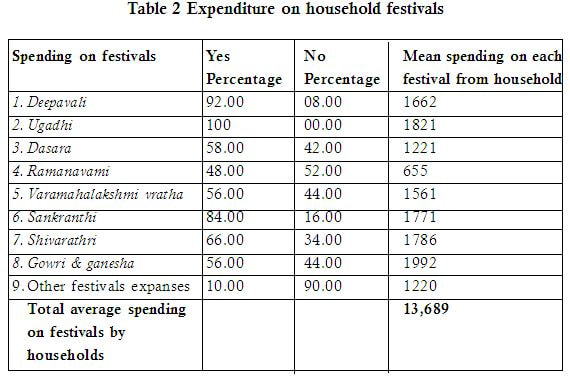

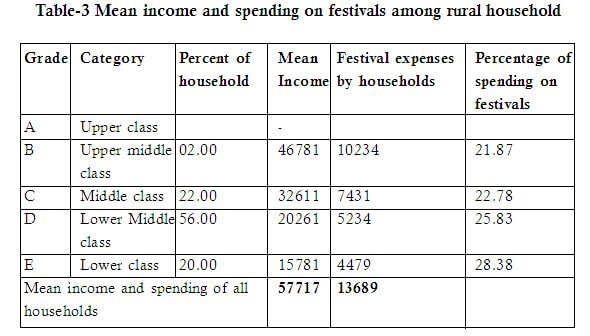

Results and Discussion The above table delineates that, majority household annual income fall between 12,000 to 25,000 INR, followed by equal sharing of households 16 percent had below 12000 INR, between 25,000 to 50,000 INR and and 50,000 INR and above per Annam respectively. It clearly indicates majority of the households comes under the annual income of 12,000 to 25,000 INR. Majority 64 percent of the households had 3 to 5 members in their house, followed by 24 percent households had 5 to 7 members and remaining 12 percent 7 and above members in their concerned household. 54 percent of the households were living with below 2 acres of land but 42 percent of the households were living without land it clearly shows livelihood vulnerability among landless. 66 percent respondents were taken loan. Whereas remaining 34 percent respondents did not taken loans. It clearly depicts majority of respondents indebted. 32 percent of the respondents have barrowed loan from SHGs, 12 percent each loan barrowed from Micro Finance Institutions (MFI) and banks respectively. Among them08 percent respondents had multi source debt and 06 percent of the respondents have barrowed loan from money lender they were heavy interest extractor. 14 percent each from agriculture and festival and ceremonies Purpose loan have taken, followed by 12 percentage each for consumption and old debt repayment purpose they have barrowed loan. 08 percent for health, 04 percent for education and 02 percentage for other purpose loan barrowed from household members respectively. From above table clearly shows that, even though low income households do not hesitates to take loan from various financial institutions for festival and ceremonial spending. The above table-2 depicts majority 92.00 percent of the respondents agreed to performing Deepavali festival among 50 households they used to spend average 1662 INR, Cent percent of the respondents agreed to perform Ugadi festival at their houses they used to spend average 1821 INR including food, clothes, gifts, entertainment so on. Majority 58 percent of the respondents agreed for performing Dasara festival at their house, average spending was 1221 INR for the festival. 52 percent of the respondents disagreed to perform Ramanavami festival but remaining 48 percent of them agreed for the same they used to spend average 655 INR. 56 percent of the respondents do perform varamahalaxmi vratha, their average spending was 1561 INR. Majority 84 percent of the respondents perform sankranthi with average spending of 1771 INR. 66 percent of the respondents perform Shivarathri with average spending of 1786 INR. Followed by 56 percent of households perform Gowri-Ganesha festival with average spending of 1992 INR and 90 percent of respondents disagreed to perform other festivals. Spending on festivities including food, clothes, entertainment, pooja, gambling and alcohol expenses. Uday pareek’s Socio-economic scale was used to assess socio-economic condition of households. From this study found that, among 50 households, there were majority 56.00 percent of the respondents falls in the Lower middle class group, 22 percent of them falls in middle class, followed by 20 percent of households were falls in lower class and remaining 2.00 percent were living upper middle class. No upper class respondents found in this study, Mean income of rural households were upper middle class was 46781 INR, middle class with 32611 INR, lower middle class with 20261 INR, lower class with 15781INR. Average spending on festivals by rural households were upper middle class with 10234 INR, middle class with 7431 INR, lower middle class with 5234 INR and lower class with 4479 INR.

Spending of different class households on festivals were as follows, upper middle class with 21.87 percent, middle class with 22.78 percent, lower middle class with 25.83 percent and lower class with 28.38 percent. Here the spending was ascending order but income was descending order. Spending goes high from upper middle class to lower class. However lower class was more vulnerable because their land holding, income, assets were meager. So, they are more susceptible to have financial vulnerability. Policy implication and need for Social Work intervention However the festival spending one of the cause of financial vulnerability of rural households in addition to that there are other causes identified from this study those are consumption, repayment of old debt, agricultural investment, starting up business and health, here spending on these needs are inevitable because these are investments for future. But spending on festivals and ceremonies can give mental happiness and cohesiveness among kiths and kins but it cannot yield future benefit. Hence, households’ members should be aware about not spending more on festivals. Government should appoint Community Social Worker at all gram panchayath level to give awareness about household budgeting, maintaining of diary and financial literacy of the rural household. Further studies can be taken up same study for urban households financial vulnerability through festivals spending, case studies can be conducted on different collective festivals in community and different castes, also studies can be done on how this financial vulnerability creating social exclusion among poor households. Conclusion Rural landless households are more vulnerable to suffer all kinds of burdens due to cultural influence they were totally driven by culture, however they never ever think spending on festivals looking like small but tiny shocks can harm larger household economy. Wheras ceremonies happen one time in a life time (marriages, Birth ceremony, funerals) but festivals are series of events can more financial shocks through smaller one. From this study proved that Festival and ceremonial expenses one of the major causes for indebtedness in addition to that, purpose of repayment of old debt some of respondents were taken loan it clearly shows rural poor repeatedly falling in to debt trap. It creates financial vulnerability and even more livelihood vulnerability among them. Due to cultural influence people are unable to prioritize needs therefore they are not able to give priority to basic needs such as food, health and education. Building awareness, including financial literacy in curriculum and bringing out anti superstition act are only remedy to prevent financial vulnerability and promote scientific life style among rural poor. References

Sachin B S Research Scholar, DOSR in Social Work, Tumkur University Rajashekar C Research Scholar, DOSR in Social Work, Tumkur University Dr. Ramesh B. Professor, DOSR in Social Work, Tumkur University |

Categories

All

Social Work Learning Academy50,000 HR PROFESSIONALS ARE CONNECTED THROUGH OUR NIRATHANKA HR GROUPS.

YOU CAN ALSO JOIN AND PARTICIPATE IN OUR GROUP DISCUSSIONS. MHR LEARNING ACADEMYGet it on Google Play store

|

SITE MAP

SiteTRAININGJOB |

HR SERVICESOTHER SERVICESnIRATHANKA CITIZENS CONNECT |

NIRATHANKAPOSHOUR OTHER WEBSITESSubscribe |

MHR LEARNING ACADEMY

50,000 HR AND SOCIAL WORK PROFESSIONALS ARE CONNECTED THROUGH OUR NIRATHANKA HR GROUPS.

YOU CAN ALSO JOIN AND PARTICIPATE IN OUR GROUP DISCUSSIONS.

YOU CAN ALSO JOIN AND PARTICIPATE IN OUR GROUP DISCUSSIONS.

|

|

RSS Feed

RSS Feed