|

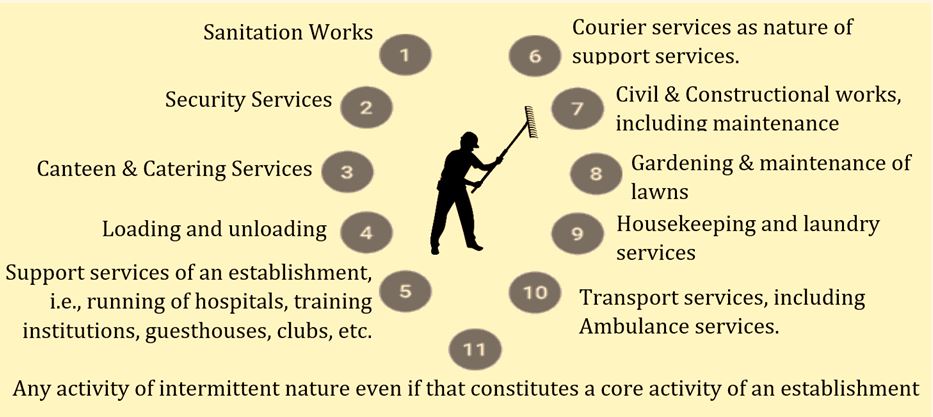

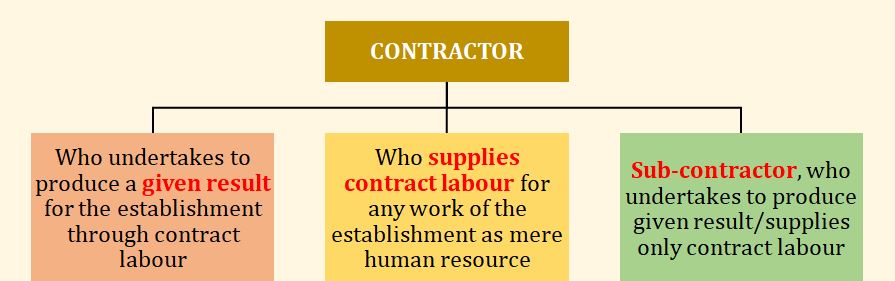

Q1. What activities are not "core activities of an establishment" under the Occupational Safety, Health, and Working Conditions Code, 2020? As per section 2 (p) of the code, the following activities are not core activities, if the establishment is not set up for performing such activities: Q2. Who is the "Contractor” as per the Occupational Safety, Health, and Working Conditions Code, 2020? Section 2 (n) of the Code refers to the definition of "contractor". Q3. Who is the “Contract Labour” in accordance with the Occupational Safety, Health, and Working Conditions Code, 2020? Section 2 (m) of the Code refers to the definition of "Contract Labour." The worker meeting the following criteria is contract labour as per the Code:

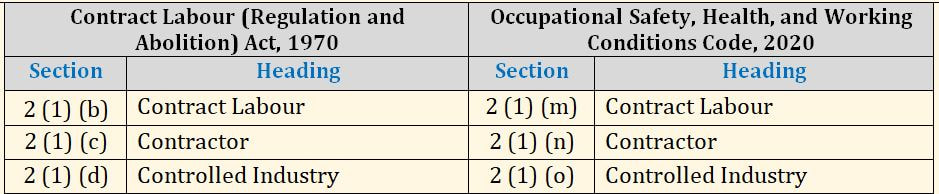

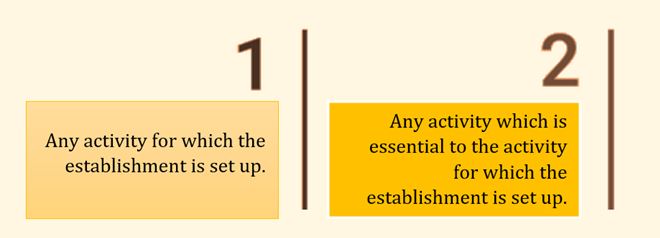

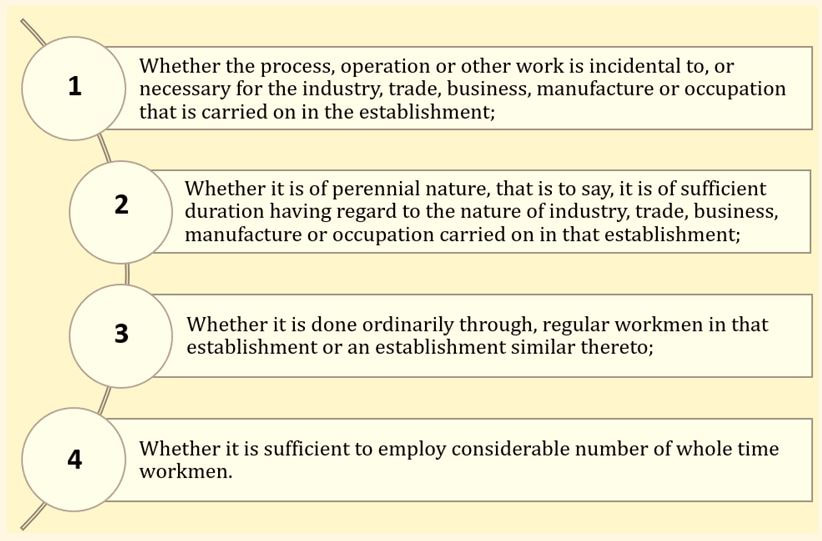

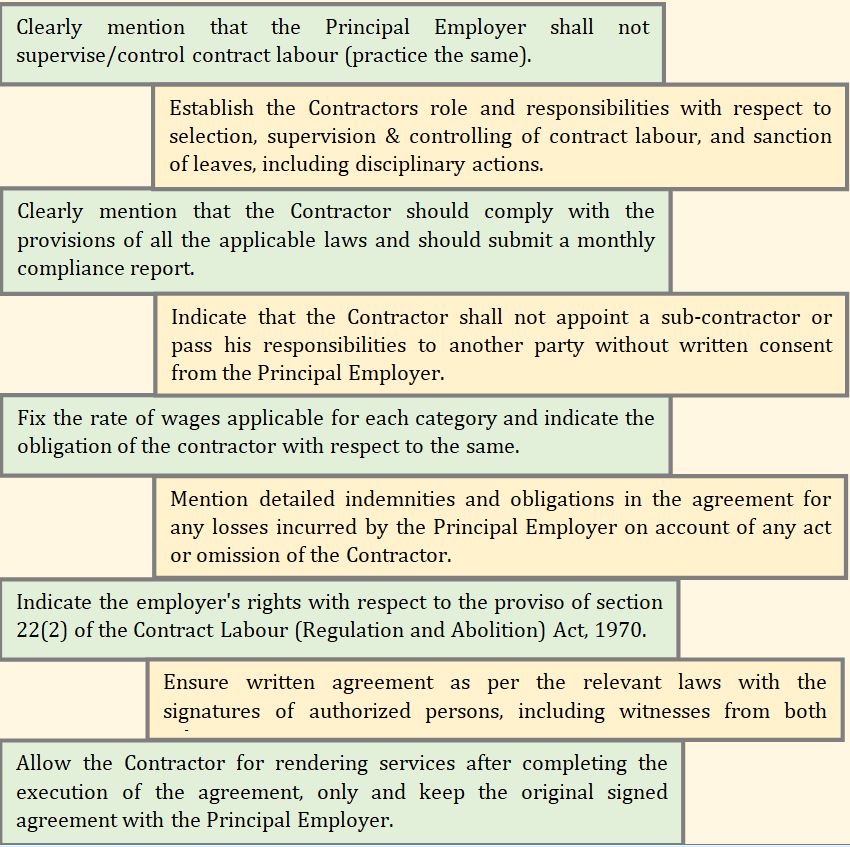

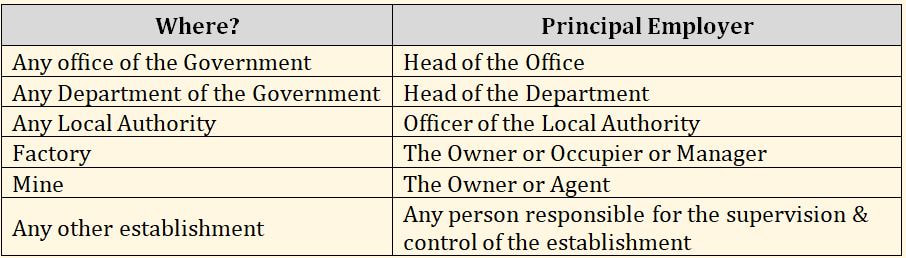

Q4. What sections of the Current Act and the Proposed Code define the Contract Labour, Contractor, and Controlled Industry? Q5. What is the “core activity” as per the Occupational Safety, Health, and Working Conditions Code, 2020? Section 2 (p) of the Code defines the "core activity of an establishment." As per this, the core activity means: Q6. What is the proviso in the current law regarding the prohibition of employment of contract labour? Section 10 of the Contract Labour (Regulation and Abolition) Act, 1970 indicates the prohibition of employment of contract labour. This act is one of 13 laws being consolidated under the Occupational Safety, Health, and Working Conditions Code, 2020. This section empowers the appropriate Government to prohibit, by notification in the Official Gazette, employment of contract labour in any process, operation, or other work in any establishment. Before issuing any notification, the appropriate Government should examine the conditions of work and benefits provided for the contract labour in that establishment and other following relevant factors: Q7. Which key principles the Principal Employer should keep in mind while entering into an agreement with the Contractor for supplying the Contract labour? The following key principles are highly important when entering into an agreement with the Contractor: Q8. Who is the "Principal Employer" under the Occupational Safety, Health, and Working Conditions Code, 2020? Section 2 (zz) of the code defines the “Principal Employer.” If the Contract Labour is employed or engaged in the establishment, the Principal Employer means: Q9. What type of liability the Principal Employer has under the Contract Labour (Regulation and Abolition) Act, 1970? As per sections 16, 17, 18 & 19, the contractor should provide the following welfare and health amenities to the labour employed by him: Canteen | Restrooms | Drinking water | Latrines and urinals | Washing facilities | First-aid facilities If any of these amenities are not provided by the contractor to the contract labour employed in the establishment, the Principal Employer is automatically liable to provide the same as applicable. The Principal Employer can deduct all expenses incurred to provide such facilities from the contractor. As per section 53 of the Occupational Safety, Health, and Working Conditions Code, 2020, the Principal Employer of the establishment is responsible to provide the welfare facilities as per section 23 (Provisions of Health, Safety & Working Conditions) and section 24 (Welfare Provisions) of the code to the contractor labour who are employed in such establishment. Q10. What is the responsibility of the Principal Employer with respect to Payment of Wages for the Contract Labour? A contractor is responsible for the payment of wages to each worker employed by him as contract labour before the prescribed period as per the Contract Labour (Regulation and Abolition) Act, 1970. The same proviso is retained in section 55 (1) of the Occupational Safety, Health, and Working Conditions Code, 2020. As per section 21 (4) of the Contract Labour (Regulation and Abolition) Act, 1970, in case the contractor fails to make payment of wages within the prescribed period to contract labour, then the Principal Employer shall be liable to make the payment of wages to the contract labour employed by the contractor. In such a case, the Principal Employer is eligible to deduct the same from any amount payable to the contractor. The same proviso is retained in section 55 (3) of the Occupational Safety, Health, and Working Conditions Code, 2020.

0 Comments

Leave a Reply. |

Categories

All

HR Learning and Skill Building AcademyMHR LEARNING ACADEMYGet it on Google Play store

|

||||||

SITE MAP

SiteTRAININGJOB |

HR SERVICESOTHER SERVICESnIRATHANKA CITIZENS CONNECT |

NIRATHANKAPOSHOUR OTHER WEBSITESSubscribe |

MHR LEARNING ACADEMY

50,000 HR AND SOCIAL WORK PROFESSIONALS ARE CONNECTED THROUGH OUR NIRATHANKA HR GROUPS.

YOU CAN ALSO JOIN AND PARTICIPATE IN OUR GROUP DISCUSSIONS.

YOU CAN ALSO JOIN AND PARTICIPATE IN OUR GROUP DISCUSSIONS.

|

|

RSS Feed

RSS Feed